|

|

|

Politics

Main Page |

Rising Rent in Baltimore Cited by Homeless as Concern

Maryland Newsline Monday, May 7, 2007 BALTIMORE – On a recent morning, Deanna Walker, 40, sat in front of a case worker in the dining area of Brown's Memorial Church Shelter, a block from the Pimlico racetrack in northwest Baltimore. Walker said she had lost her job the week before. She had been working in a cleaning occupation, full-time, for $10.50 an hour. About six months earlier she had been living in a rented basement, she said. But the house was sold, and she had to leave. Since then, Walker said, she has been unable to afford a place of her own, and had been moving between hotels and shelters, exhausting paychecks and tax returns. Two of her children played around her as she told her story. It was their third day at this shelter. The high cost of renting in Baltimore is one of the factors pushing people into homelessness, social workers and homeless people like Walker say. A 2005 census of Baltimore's homeless by city officials found that the overwhelming majority of the 902 people surveyed -- 64 percent -- said that a lack of affordable housing was their No. 1 unmet need. Other factors contributing to homelessness included lost jobs, disabilities, family problems, broken relationships, substance abuse and mental health problems, social workers and the homeless said. The census estimated, in 2005, that there were between 6,522 and 7,023 people who experienced homelessness during the course of the year. Earlier and more recent figures were not available, city officials said. Rents Climb as Percentage of Income In 2005, to rent a 1,000-square-foot apartment in a mid-level Baltimore complex, a person had to spend almost $950 a month, or $11,280 a year, according to data compiled by GRA, a unit of Charles Schwab Investment Management, and analyzed by Maryland Newsline. That was the equivalent of 35 percent of Baltimore's 2005 median household income of $32,456 a year, as measured by the U.S. Census Bureau. By comparison, GRA’s data showed that the national average rent for a similar-sized apartment was 25 percent of the median household income, as measured by the U.S. Census Bureau.

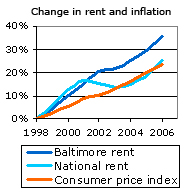

Six years earlier, in 1999, GRA’s data showed that the same Baltimore apartment rented for about $750 a month, or $9,047 a year -- about 30 percent of the city's median household income of $30,078 a year, as measured by the Census Bureau. Rents in Baltimore have risen faster than inflation. After adjusting for inflation, from 1999 to 2005, the cost of renting a 1,000-square-foot apartment in a mid-level complex in Baltimore rose 8 percent. Rents have also risen faster than wages. From 1999 to 2005, median household income in Baltimore increased by 8 percent, according to the U.S. Census. During the same period, Baltimore's rent rose 25 percent in nominal terms, while the national average rent rose 13 percent. As a result, the number of Baltimore households paying rents higher than 30 percent of income -- a well-accepted rule of thumb for affordability -- increased from 47 percent of renter-occupied units in 1999 to 56 percent in 2005, according to the U.S. Census Bureau. Good Jobs, Higher Home Prices Take Toll Paul Wildes, director of product management, real estate investments and research at GRA, a unit of Charles Schwab Investment Management, said several factors are driving rents up. One is good local jobs, which push up demand for apartments. Home affordability also plays a role, he said. When homes get too expensive to purchase, prospective buyers choose to rent instead, pushing rents higher, Wildes said. Another factor is supply, he wrote in an e-mail. "In recent years there has been a real lack of construction of new apartment units in many markets. Plus, in 2005-2006 there was a huge wave of conversions of apartment properties into condos." The result, he said, is there are fewer apartments to rent in many markets, driving up rents. The City of Baltimore's 2005 homeless census found that of 902 people surveyed, 38 percent said that they became homeless because of a health or disability problem; 23 percent said it was due to lack of income; 15 percent said it was because of a housing problem, among other causes. That same survey identified a lack of affordable housing as the No. 1 unmet need of the majority. The document also said that the majority of homeless people in Baltimore had an income of less than a third of Baltimore’s median wage. It was not possible for them "to pay for housing as well as other basic living expenses even with public assistance or full-time employment." Some Workers Can't Make Rents In Baltimore, a city where in 2005 almost a quarter of the population lived below the poverty line, according to the Census Bureau, the search for an affordable place to live can be daunting. While some good jobs are being created in Baltimore, wages for those at the bottom can hardly match rising rents. According to the U.S. Bureau of Labor Statistics, in May 2005 the median hourly wage in Baltimore was almost $16 an hour. But a janitor made $8.62, a cashier $8.05 and a dishwasher $7.74. A 2003 study published by the Maryland Department of Housing and Community Development estimated that in order to rent a one-bedroom apartment in Baltimore and pay for other living expenses, a person needed an hourly wage of at least $14 an hour. Ruth Cox, case manager at Brown's Memorial Church Shelter, said that many of her clients lack good credit, or do not have the income necessary to rent a place. She said that some of them get only about $200 a month in temporary assistance for disabled adults from the Maryland Department of Social Services and $150 a month in food stamps from the federal government. "Can't nobody live off of that," she said. Some of her clients are ineligible for Social Security. Others are waiting for it. Those who do get Social Security checks get about $600 a month, Cox said. "It's not really too much we can do with that," she said. Copyright © 2007 University of Maryland Philip Merrill College of Journalism Banner graphic by Hortense Barber and Diego Mantilla. Banner photos are courtesy of Greg Sileo.

|